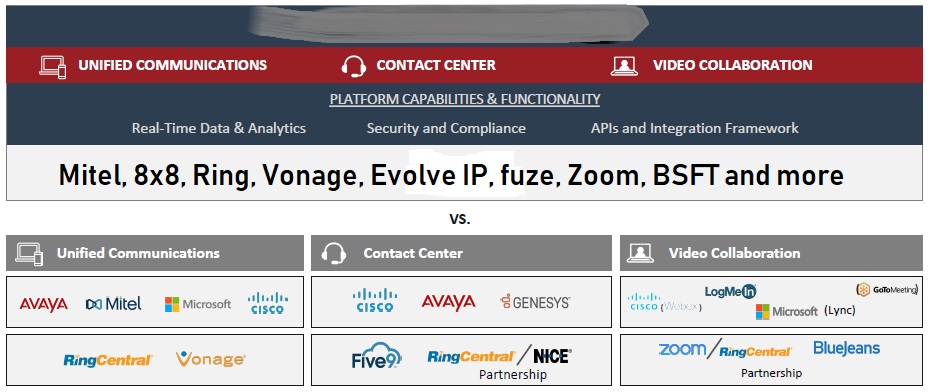

I have a hard time telling the Big 3 apart. RingCentral, Vonage and 8×8. They make the same noise, about the same things and all have very similar functions – PBX/UC+ContactCenter+Video+CRM. All 3 are pushing a single software platform.

Here are some thoughts on the Big UC 3 and their reports.

In a RingCentral investor deck, RC says that for knowledge workers, voice is only 44% of how the communicate with team messaging and texting about 30% each and video about 11%. Email not on that graph. I guess Slack is under team messaging. Please note that it says for Knowledge Workers. There are about 130M full time employees in the US. Somewhere between 40-45% are knowledge workers (55-60M).

If you consider that most workers are in fact NOT knowledge workers, then the true UC market is just 60M in the US. The other 70M need dial-tone and location based phone.

8×8 puts out the best stats in their reports. The key point I saw for 8×8 was: “Bundled UCaaS & CCaaS Continues to Resonate: 52% of new MRR from mid-market/enterprise were combination deals.”

- Total ARPU is $516 at 8×8. It is $408 at VON. Ring did not report.

- Mid-market ARPU is $5364 for 8×8

- 8×8 has no debt. VON has $559M and RNG has $410M.

- 1M+ global seats by 8×8. No one else reported seat/user numbers.

Total quarterly revenue for:

- Ring has $201M, 34% growth YoY.

- Vonage is $280M; Vonage Business is $180M, 31% growth YoY.

- 8×8 is $93.8M, 18%. 2019 full year is $334.4M

They all seem to focus on midmarket/enterprise. [Not certain they all define mid-market the same.] Likely that is because it is what investors want to see or it is the only way to keep the machine churning. Although if they could be efficient on deals under 100 seats they could win all day. Yet 64% of the revenue from 8×8 is in small business. [8×8 defines small business as customers with revenue <$50m.]

In Ring’s last investor deck, Overall Office churn is 10%! Channel driven sales have half that churn. Channel driven sales have more revenue. The deck is a lot projections and fluff. They talk about innovation but it’s all M&A.

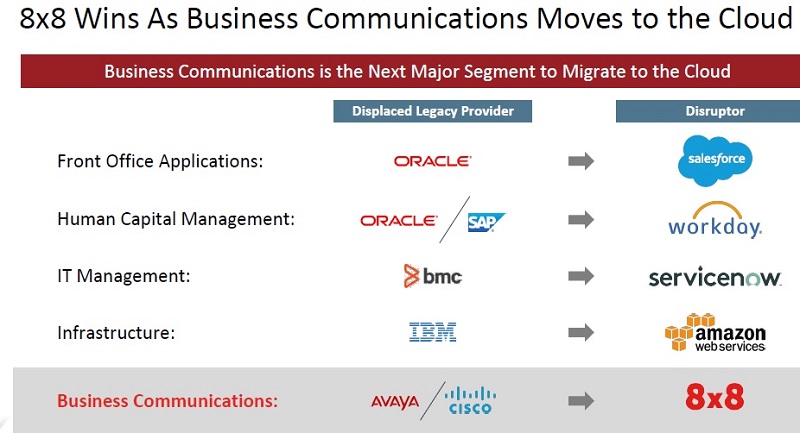

To show the disruption that 8×8 (being the oldest) is causing:

The funny thing is that AWS & Azure have beat up IBM Cloud (and Google Cloud), but 2000 providers have had a chance to disrupt the premise PBX in the last 15 years with little luck. It took Salesforce, who started in 1999 as an ASP, just 10 years to hit $1B in revenue. Ring started in 1999; VON in 2001; 8×8 in 1987; and Zoom in 2011. None have hit $1B in revenue.

BTW, Zoom went public.

- It posted $330 million in revenue in the year ending January 31, 2019 with a gross profit of $269.5 million

- It more than doubled revenues from 2017 to 2018, ending 2017 with $60.8 million in revenue and 2018 with $151.5 million.

![]()

At least these numbers look reasonable from a partner perspective, unlike the partner stats that RING used.

![]()

What is Cisco doing with Broadsoft? As I mentioned in my weekly newsletter, the rumor out of Cisco is that no more development on Broadsoft softswitch and Broadworks. Going forward it is what it is. Cisco is using it to power their key cloud service: Webex Teams. (At least this year it is the showcase service like Spark was before it.) Cisco likes to end of life things like Team One.