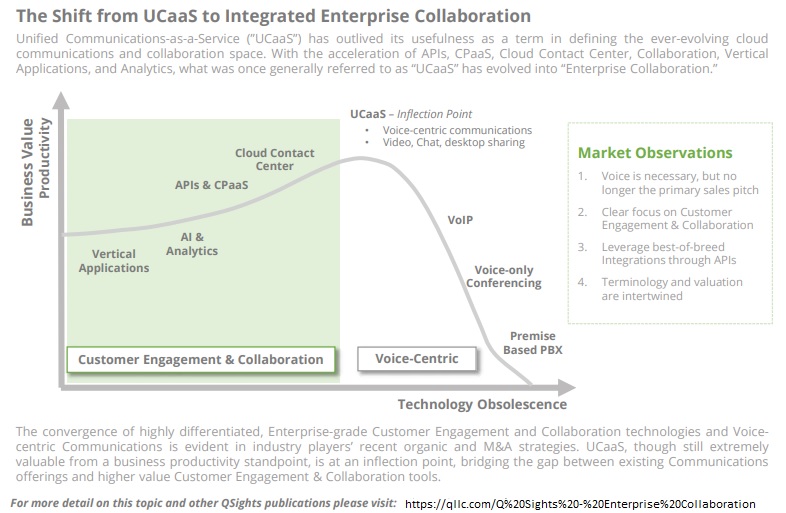

So as Cisco gets ready to party at the Cisco Contact Center Summit in Miami this week, I have been musing about what happens next in UCaaS/UC&C. The analysts at the Cloud Comms Summit (CCS) said that UCaaS is dead as a term and it is more about Enterprise Collaboration. Okay, so how does that go?

Microsoft is at 50 million seats with Teams/O365. Google Apps isn’t even in the running in this space anymore except in the small business space. I like Google Apps; it is easy to use, easy to share. But no support and the we don’t give a crap about privacy make it a hard swallow for many businesses.

Cisco wants Webex Teams to compete with Microsoft. They are late to that party after wasting time on Spark. What about Slack, Zoom or GoToConnect?

Zoom is crushing it right now. If they stay focused and keep executing, they win their sector. Hands down.

Slack needs more conversion. And what they really need is more marketing. Due to the historical data it stores, Slack lands and stays – but for how long? And will it be enough? [Prof. Galloway has a quick take on Slack HERE.]

Personally, I think Slack should partner or buy a conferencing app like Gather. If you could jump to a video huddle and white-board AND have that conference be recorded and transcribed, it would add to the data that Slack stores. It would also add a review stream to Slack – a company that needs all the revenue it can get. This mash-up would give Slack some weapons against MS taking them out.

Jive mixed with GoTo Meeting is now GoToConnect. No idea if this will even be able to compete with Webex Teams. LogMeIn hasn’t clearly articulated where it is going or what the vision is with this bundle. And that means confusion – in a time when you have to clear to beat the 800 pound gorilla.

It might be that Contact Center becomes part of the stack – or it might remain a stand-alone. More likely, the one most closely integrated with CRM and Workflow software will win.

So many software projects fail that stand-alone may work in the enterprise for years. Or they may finally see the light in the tunnel that is Integration – and hope it isn’t another train coming to run their project over.

It might be that Avaya stays in business reselling RingCentral and collecting licensing and maintenance fees.

It might be that Microsoft joins with Twilio or bandwidth.com to handle the telephony piece (via CPaaS) to wipe Webex off the map. If it is Twilio, they get to put their contact center (Flex) on top of MS Teams for the full Monty for customers. Microsoft doesn’t have to touch telephony – and their Teams customers get the full stack – CPaaS + UCaaS + CCaaS + Collab – no room for a competitor to get its foot in the door. This is a scary proposition in the over 1000 seats sector (mid-market and enterprise).

If that does happen, it marginalizes every other provider.

If BroadWorks goes end of life in the next year (it will, bet on it), what is the valuation of any business using BW tech? It approaches zero.

Vonage’s CEO says this: “Everything lives on a single platform, providing businesses with a simpler solution and giving their customers a better, more streamlined experience” That’s what RC, VON, Nextiva and 8×8 are hoping for. Salesforce could have owned this but wanted nothing to do with telephony. Now Twilio has telephony figured out. And they have an ecosystem. We’ll see what happens.

So 8×8 is top ranked in SIP Trunking, according to NoJitter. It is great that they are good at the simplest component of the stack, but juxtapose that with being top ranked for Cloud Contact Center or even UCaaS. It hasn’t happened yet. So maybe over-paying for a CPaaS player was smart.

There are so many moving parts right now because it took Hosted PBX 15+ years to become UCaaS and only penetrate <20% of the market. It reminds me of every single CLEC in the US. None were able to capture more than 100K business accounts. Can a UCaaS provider survive with under ten million in revenue? I don’t know.

This sentiment from Q Advisors was shared by a few analysts at the CCS. The one point of view you have to understand is that they are NOT talking about SMB!!!! By definition, SMB is 500 employees and less. 90+ percent of the employers are SMB. How do you take advantage – with scale – of the fifty to one hundred seat business? Or the 25 seat businesses?

It isn’t just customer acquisition cost. It is also the high cost of implementation and support. Operations, provisioning, and service delivery are functions that would need repeated excellence (nod to Tom Peters). It is a focus and execution problem that no one has figured out. Most providers still just worry about sales. Not marketing, not service delivery. Not culture. It’s like In Search of Excellence was never written.

In the under 10 seat deal, the first company to e-commerce that by selling CPaaS like a domain may win. When you buy a domain name from GoDaddy or whoever, there are multiple windows upselling extras that the buyer has to click through. What if you started with dial-tone and a DID, asked about SMS, then voicemail, transcription, ACD, IVR, hunt group, etc.? You could build a seat for the customer – if you could provision it correctly and bill it right. Probably the reason it hasn’t been done, but that is essentially what CPaaS is capable of.

Lot of question marks. A few things I would really enjoy see happen, but it likely will not happen. We’ll wait and see.