Someone sent me this Podcast with James Anderson & Kameron on Spotify. James is a writer for Informa TechTarget that posts on Channel Dive – what kind of name is that?

Kameron spent 3 years at Telarus and now runs a family business called Channel Advisor for vendors.

I agree with James, most people that touch the channel not only do not understand the channel, but can’t recognize the different business model types within that sphere. This literally is the reason so many channel programs fail. If the vendor is not aligned with the channel partner and its business type, trouble. Period.

Even Kameron struggled with the names of channel types. Agent (now called Trusted Advisor), VAR (box pushers), Inter-Connects (PBX pushers), MSP (managed services is in the name), MSSP (cybersec), ISV (devops), SI (projects) and Referrals/Ambassadors/Affiliates. There are likely a couple of others, but these are the major ones I have seen and worked with and in.

There are also Master Agencies that are now called TSBs and TSDs. They are brokerages that carry the vendor contracts and partners sell through these TSBs in order to get paid commissions.

There are distributors like Ingram Micro and TD Synnex that are logistic partners for Microsoft, Dell, HP, IBM and 100K other vendors that need parts, licenses and hardware shipped out globally for partners to do their business. I worked at a VAR for 3 years and TD was our primary disti. I worked with TD a few times over the years to help them develop a TSB. They just don’t get it.

Ingram has a TSB and a cloud brokerage inside the company, but a majority of its revenue is in legacy distribution.

Distribution can have 100’s vendors because they are similar to Amazon and work through a SKU based system. No SKU, no sale.

TSBs are maxing out at 400 vendors because it is a lot of work to add suppliers to the back office. Even harder to sign a contract with a vendor that gives the TSB MDF and a small quota. Quota is the problem. The TSB doesn’t know if any of its partners will actually close deals regularly for that vendor.

Telecom, UCaaS, CCaaS, CPaaS and many other technologies are not easily SKU’ed. Check your bills for all those line items and see for yourself.

The podcast and many other folks get confused about the MSP space. James should have had these facts because they come straight from Informa: “Recent research indicates roughly 341,000 channel partners in North America offer managed services, including MSPs. Channel Futures reports roughly 341,000 MSPs globally by 2025; North American MSPs are estimated around 150,000 to 160,000 based on Canalys data.”

The exact number of MSPs can vary depending on how a “Managed Service Provider” is defined. Industry pundits like Jay McBain (Chief Analyst at Canalys) often categorize these firms into three distinct tiers:

– Pure-Play MSPs (~43,000 – 45,000 in North America): These are firms that derive more than 50% of their revenue from recurring managed services. This number aligns closely with the United States census figure of 44,584.

– Hybrid Providers (~86,000 globally): These are firms where managed services represent at least 30% of their revenue, but they still rely heavily on project-based work or hardware sales.

– Broad Channel Partners (~341,000 globally): This includes any IT firm (VARs, System Integrators, etc.) that offers at least one managed service contract. North America accounts for roughly 45% of this global market’s revenue.

Now, take any of those figures and realize that 80-85% of these partners do less than $5M in annual revenue; have less than 10 employees; and the only sales rep is the owner. The average MSP has less than 150 customers. The average business is the US has 12 employees.

{NOTE from ConnectWise: That said, he continues, citing data from ConnectWise’s Service Leadership unit, 81% of MSPs do less than $10 million top line annually at present and 67% do less than $5 million. “Those are small businesses,” Sobel notes, and unlike PE-owned firms with access to centralized services from experienced professionals, they have to learn everything from sales and marketing to billing, hiring, and beyond more or less on their own through trial and frequent error.}

[12 employees x $100 per laptop for managed IT x 120 businesses x 12 months = $1.7M per year ]

The podcast touched on compensation.

SPIFFs – vendors have tried to get rid of SPIFFs, but then find out that sales dip. Some of this has to do with the partner business model. Some of it has to do with how much work goes into a sale – pre-sale and post-sale effort from the partner.

While many vendors express that partners just throw a lead at them and are not involved afterwards, I say you should change the comp for THOSE specific partners.

If the average sales size if $240 (12 x $20 for SaaS/UCaaS or AI), it is simpler, faster and easier for a partner to sell connectivity than to try to sell SaaS, UCaaS or AI. SPIFFs will get the attention of the partner.

Think about this: the CAC (customer acquisition cost) for cellular involves a phone – $1000. It gives the carrier, price and customer lock-in for 3 years.

In UCaaS direct sales, there is lead gen, SDR, and account reps involved in every sale. What is that cost?

SPIFFs and commissions are success based. You only pay when you close a deal and the customer pays – and stays. (Vendors claw back SPIFFs if the customer doesn’t pay and stay for the contract term.)

Evergreen commissions – I hear it is unsustainable for vendors to pay for evergreen commissions. So far commissions have not been the reason any vendor has gone bankrupt in the 27 years of me being an Agent.

I didn’t understand the comment on the podcast about coin-operated. Vendors have always thought that Agents are coin-operated – and they treat us that way. Then get mad when we want out success based commission. Someone explain the disconnect?

There are many vendors who want in the channel but don’t like the comp model. They can certainly try a different comp model, but they better bring demand for their services. Big demand. Cable doesn’t SPIFF or pay much commission on cable modems because there is demand. Microsoft pays nickels for MS Teams comp.

As I explain in my book, Channel Myths, the channel does not create demand, we just supply it. But vendors don’t understand the channel – in fact, most consultants, advisors, channel heads and pundits, don’t have a full grasp of the channel, just on a piece of it.

James asks, If this space had an analyst??? I think Jay who works for Informa would question this comment.

An additional thought on Informa. Informa owns Channel Partners, MSP Summit, Omdia, Canalys, Black Hat, Enterprise Connect and more properties (events, websites, research). It bought TechTarget in 2024. The firm says the channel is growing, yet all the channel media is being acquired by one org?! That doesn’t represent growth. Neither does shrinking conference attendance.

Once the podcast starts discussion about how many vendors does Pax8 or TD Synnex have, I gave up.

[When you listen to a podcast or a speech, remember that it is all anecdotes. Mine included. ]

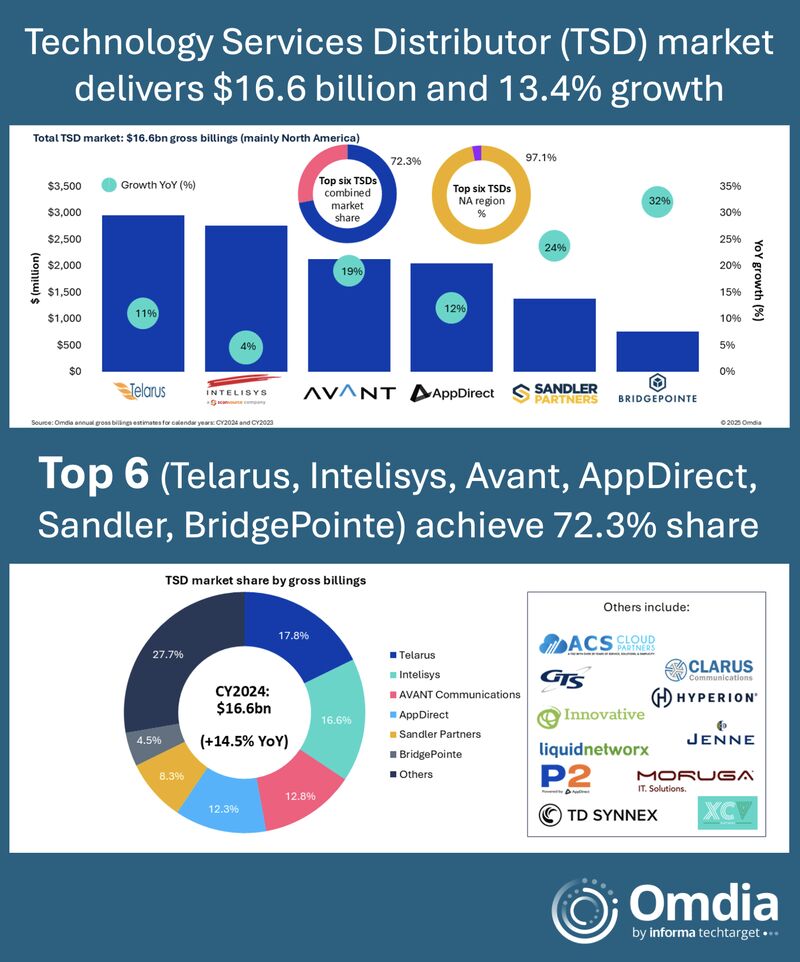

This is from Jay from Informa/Canalys today: