Each analyst has a different idea of the market size of UCaaS globally. The global estimates range from $20 Billion USD in 2021 to $46B USD. That’s a wide range.

Yet the service providers don’t really break out the revenue. CPaaS, CCaaS, UCaaS, Collaboration, Video, SIP Trunking, Direct Routing – where do all these buckets of money fall?

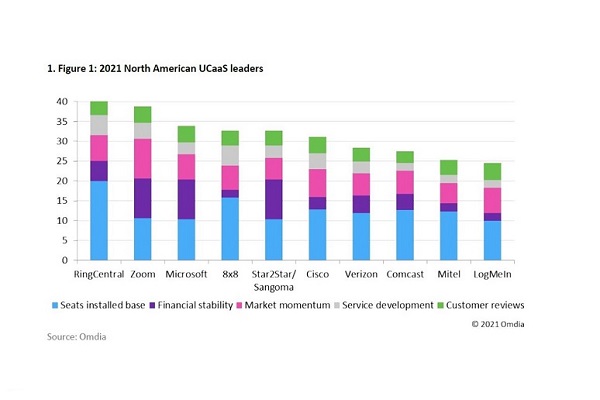

What is a UCaaS seat? Is it a video license from Zoom or just the Zoom phone license? Are Mitel’s 3M advertised cloud seats considered UCaaS? Well, not any more. RingCentral will be counting any of those cloud seats.

RNG has about 3.5M seats and $1.2B in revenue.

8×8 has 2M seats and $601M but 100K DR4MT clients.

Vonage has $1.25M in revenue but most of that is CPaaS.

Zoom has 2.4M phones and $4 Billion in revenue, much of it in video.

Microsoft has about 5M MS Teams Phones (of the 80M) plus 270M MST licenses. (5M x $10 + $38/mo for 80M E5 licenses + 190M F3 licenses @ $8/mo = $600M + $36Billion + $18B = $55B for UC&C for MS depending how you classify that.)

The rest of the Top 10 estimate at 5M seats. The 10th spot was 875K seats according to Gartner MQ – and then it starts dropping.

The top 11-20 estimate at 3M seats combined.

The next 1900 providers combined might equal about 10M seats with an average of 5K seats each.

Netsapiens (now owned by CXDO) has a total of 2.5M seats on its platform, which includes all it’s white labelers. CXDO’s total revenue is $28M. Most UC providers never hit the $100M in revenue mark. Resellers of a white label provider or regional UC providers rarely hit 10K in seats.

10M+3M+5M+2.4M+3M+3.5M= 27M seats x $21 x 12 months = call it $7B plus whatever Microsoft contributes to this number. But this is largely North America total; not global.